georgia ad valorem tax motorcycle

If you pay by check your check must have your Fayette County address printed on it. 20 Annual License Reg.

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

Motorcycles may be subject to the following fees for registration and renewals.

. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. 5 to State of Georgia General Treasury. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

A reduction is made for the trade-in. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. Of the 45 Annual Renewal fees the fees.

Valid drivers license or picture ID. It is your responsibility to renew at the appropriate time whether you receive a notice in the mail. If itemized deductions are also.

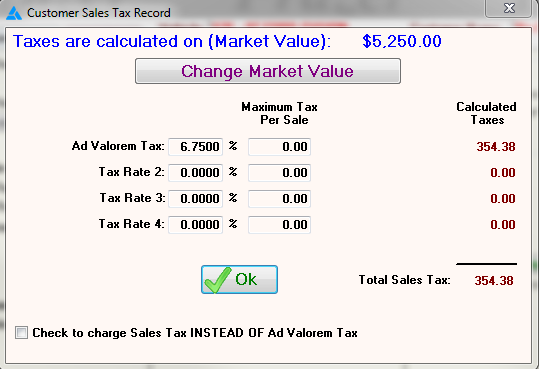

Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle. Subject to the pricevalue of the vehicle. Georgia law requires that you apply for or transfer title and registration for your vehicle within 30 days of moving to Georgia or.

80 plus applicable ad valorem tax. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Only one additional plate issued.

You can determine the TAVT amount at the following link. Based on the market value of your motorcycle. Sales Tax or Title Ad Valorem Tax TAVT Varies.

45 plus ad valorem tax if applicable. Of the Initial 45 fees collected for the issuance of these tags the fees shall be distributed as follows. For tax year 2018 Georgias TAVT rate is 7 prtvrny.

If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle. 4500 plus ad valorem tax if applicable. Ad Valorem Taxes If applicable.

This means that it will vary depending upon whether it is a new motorcycle that you have bought or a used one. Eservicesdrivesgagov If instead you intend to take delivery and keep the vehicle in Tennessee beyond the three-day-period you must pay the appropriate Tennessee sales tax. Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows.

4500 plus ad valorem taxif applicable. Of the Initial 45 fees collected for the issuance of these tags the fees shall be distributed as follows. Fee 1 to the County Tag Agent 19 to Sponsoring Organization 5 to State of Georgia General Treasury.

Cost to renew annually. This calculator can estimate the tax due when you buy a vehicle. Cost to renew annually.

1 to the County Tag Agent. Of the Initial 45 fees collected for the issuance of these tags the fees shall be distributed as follows. Generally any motor vehicle purchased on or after March 1 2013 and titled in Georgia is exempt from sales and use tax and the.

1 to the County Tag Agent. 59 to State of Georgia General Treasury. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA.

Registration Fees Taxes. 20 Annual License Reg. To enter your Personal Property Taxes take the following steps.

If you are purchasing or transferring ownership of a vehicle you should apply immediately for your title and obtain or transfer a Georgia license plate at your County Tag Office. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Special handling fee for expedited title processing In-Person replacement titles and title corrections only 1000.

If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time. Cost to renew annually. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia.

Call the Taxpayer Services Division Help Desk 1-877-423-6711 for questions about Ad Valorem Tax that can be deducted. Of the 45 Annual Renewal fees the fees. 20 Annual License Reg.

1266 E Church Street Suite 113 Jasper GA 30143. Cost and Fees Distribution. 1 to the County Tag Agent.

Georgia requires minimum-liability insurance on all motor vehicles. 5 to State of Georgia General Treasury. To requestretain the tag a certified copy of the veteran death certificate documents equivalent Form DD-214 and Marriage License is required.

4500 plus ad valorem taxif applicable. This tax is based on the value of the vehicle. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

Cost of additional plate. As an example if the fair market value of a used vehicle in Georgia is 14000 the TAVT that the owner of the automobile is required to pay. Click here or call 706-253-8882 to reach the Motor Vehicle Registration at Pickens County Georgia government.

Contact the vehicle owners County Tag Office for questions about paying motor vehicle Ad Valorem Taxes registration and titles. Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly. March 17 2021 513 PM.

For an estimate use the MVDs ad valorem tax calculator. 2500 manufacturing fee one-time fee 2000 annual registration fee. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia.

19 to Sponsoring Organization. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system.

18 per title 20 per plate plus TAVT tax based or 3 of the fair market value of the vehicle. 19 to Sponsoring Organization. 10 of the Ad Valorem tax or 500 whichever is greater and 25 of the tag fee.

All vehicles 1986 and newer travel trailers pop-up campers and trainers exceeding 2000 pounds require a title for registration. 20 Annual License Reg. Email motorvehicleinquirydorgagov for questions about the valuation on your motor vehicle.

At that time a one-time Title Ad Valorem Tax TAVT must be paid based on the value of the vehicle. Registering or Titling a Vehicle. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or.

It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year. Cost to renew annually. 800 replacement fee plus manufacturing fees ranging from 2500 to 3500.

5500 plus applicable ad valorem tax. Sign in to TurboTax Online then click Deductions Credits Review or Edit.

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

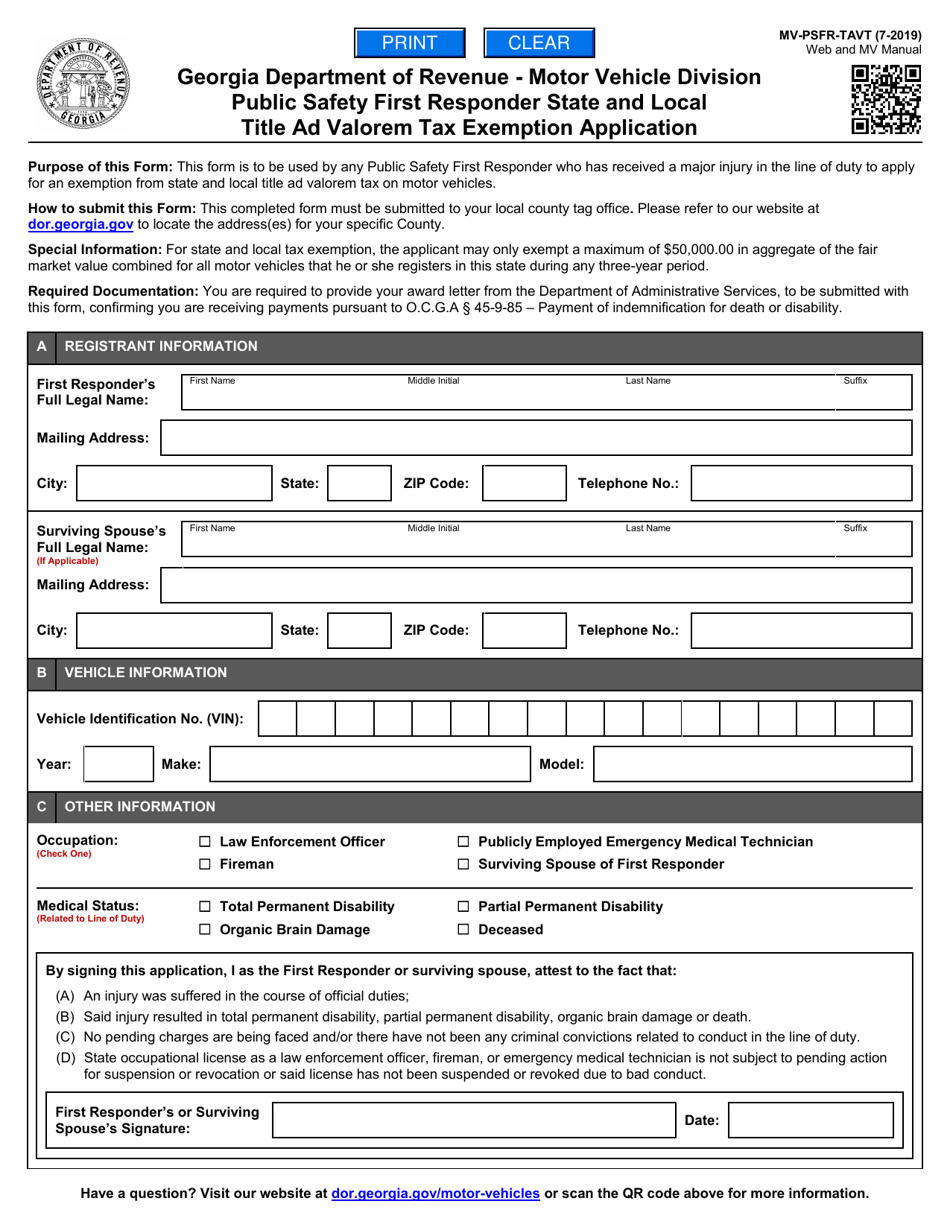

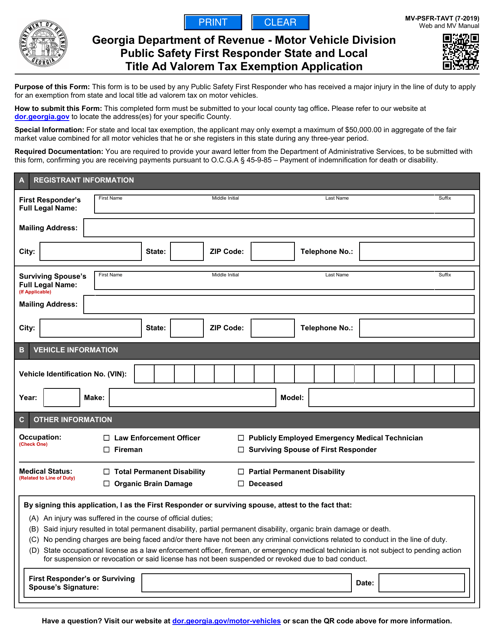

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

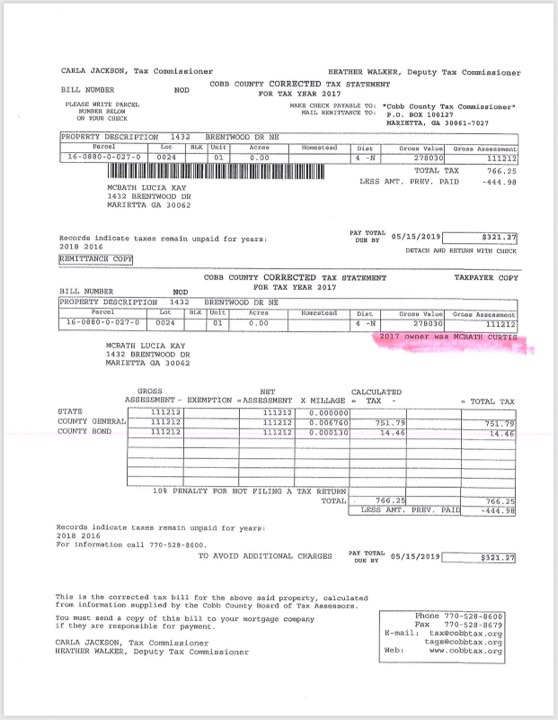

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Vehicle Taxes Dekalb Tax Commissioner

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application

New Georgia Lease Laws Milton Martin Toyota Gainesville Dealership

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Overview Cobb Tax Cobb County Tax Commissioner

Frazer Software For The Used Car Dealer State Specific Information Georgia

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

2021 Property Tax Bills Sent Out Cobb County Georgia

Tax Rates Gordon County Government

Georgia Motor Vehicle Ad Valorem Assessment Manual

Georgia Title Ad Valorem Tax Updated Youtube